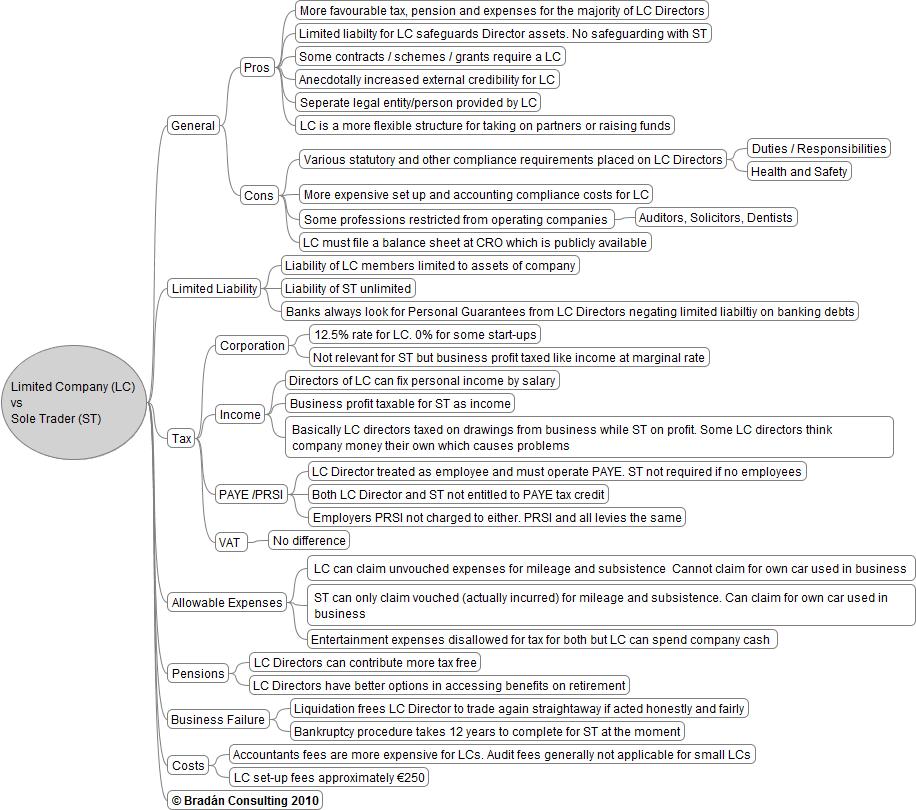

This is a question that NumberCruncher gets asked over and over. My preference is certainly for a limited company but many go for the simplicity of the sole trader and associated cheaper compliance costs. Certainly if you are a very small trader with little travel it probably makes sense. You can always incorporate at a later stage. However for the vast majority of businesses I think a company is the appropriate structure for the following main reasons:

- Much better treatment of taxes, pensions and allowable expenses

- Limited liability safeguards the owner’s private assets

- Much more flexible structure for business combinations, taking in partners, sourcing finance etc.

In the mind-map below I get into detail on all the different areas. Anybody out there with a contrary opinion or any feedback at all NumberCruncher is all ears.